Ways to Give

There are so many ways of giving and your support enables us to carry out our work. Choose the giving approach that suits you best.

Gifts in Kind

Transform your generosity into tangible impact through in-kind donations, the non-monetary contributions made to the World Parrot Trust. Elevate your giving beyond traditional monetary contributions with the transfer of any asset, such as goods or services, and join individuals, organizations, and companies in making a lasting difference.

How it Works

In-kind donations generally take two different forms:

Benefits

Your contribution may be tax deductible so please check with an investment advisor or estate planner to make sure that you receive the maximum benefit to which you are entitled.

You can be confident that the World Parrot Trust is committed to maintaining the privacy and confidentiality of your personal information.

Next Steps

- The process begins with you contacting us about the item or service to be donated.

- After the fair market value is determined, a release is signed to transfer the objects to WPT or to confirm the value of the services.

- WPT receives the goods or services and you receive charitable receipt.

Note: not all items will be able to be accepted

Get in Touch

Gifts Administrator

Glanmor House, Hayle,

Cornwall TR27 4HB

United Kingdom

Tele: +44 (0) 1736 751026

Foundations / Charitable Trusts

Grants play an essential role in enabling us to care for the parrots in our rescue centers, fighting for legislative changes in the wildlife trade, aiding front-line partners, and educating parrot owners to create a better world for parrots.

Why support WPT?

Nearly 1 in 3 species of parrots are under threat in the wild. Thousands are annually caught in the unsustainable wildlife trade and millions are kept as pets. Parrots are in need of our help to protect them and their habitats, and to ensure their survival into the future.

Since 1989, the World Parrot Trust (WPT) has been a steadfast advocate for parrot conservation, striving to protect parrots at all levels, from local communities to the global arena, and putting in tireless efforts to reverse the trend of extinction.

What We Can Offer You

We work with trusts, foundations and philanthropists to create a personal experience that benefits us all. We have a range of projects to suit individual interests, to ensure that you are as passionate as we are about protecting our parrots.

Your giving experience matters to us. That's why we offer personalized options that cater to your unique needs, whether you want to support all our work or have a specific project or species in mind.

Stay connected to the incredible impact of your gift with regular updates and photos from our ground-based conservation partners. We ensure you're always up-to-date on how your contribution is making a difference in protecting our planet's biodiversity.

We work to connect trusts, foundations and philanthropists with communities to build long-lasting relationships, through which we can create effective and sustainable change to protect parrots.

Next Steps

If you are a trustee, or have links with a Charitable Trust or Foundation and are interested in our work, please get in touch with us.

We will work with you to find the right project to meet your philanthropic objectives.

Get in Touch

Gifts Administrator

Glanmor House, Hayle,

Cornwall TR27 4HB

United Kingdom

Tele: +44 (0) 1736 751026

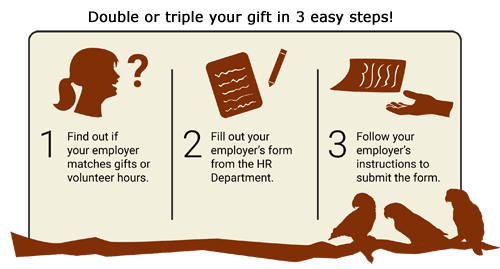

Payroll Giving Programs:

Make a big impact on parrots through workplace giving programs. Hundreds of companies recognize the value of their employee's donations by offering matching gift programs to double or triple their value.

For Employees

You can participate in your company's giving program simply by giving small, regular donations directly from your pay. If your company participates in this kind of a program, get a Matching Gift form from your employer, fill out your portion, and mail it in the reply envelope with your donation.

Increasingly, more and more companies also offer online Matching Gift processing, so no form is required – just let them know you donated to us, and they take care of the rest. Some companies even offer donation via payroll deduction, so we receive your donation and their matching gift in one lump sum!

For Companies

Experience the excitement and fulfillment of joining a global community dedicated to preserving parrots through these impactful programs. By inspiring employee engagement and setting ambitious fundraising targets, your company can make a real difference in the lives of threatened and endangered parrots.

You can elevate workplace morale and showcase your company's social responsibility through charity corporate partnerships - one of the most impactful ways to make a difference. Many of these charitable contributions are often tax-deductible. Many organizations often choose to match their employees' donations dollar for dollar or with a percentage of the total donations to the World Parrot Trust.

Next Steps

Join us today to help protect these magnificent creatures and their habitats!

And please remember to let us know about your giving plans so we can express our gratitude.

Get in Touch

Gifts Administrator

Glanmor House, Hayle,

Cornwall TR27 4HB

United Kingdom

Tele: +44 (0) 1736 751026

Gifts of Property

Turn your generosity into a real and measurable impact by donating real estate to the World Parrot Trust.

Why support WPT?

Donating real estate to the World Parrot Trust can offer you several potential benefits:

You may not have to pay tax on land or property you donate to WPT. This includes selling them for less than their market value.

Ways to Give

There are several options available for donating real estate. Two of the most common methods are:

- Direct Donation: By donating the real estate you own to the World Parrot Trust you may qualify for an income tax charitable deduction equal to the fair market value of the property. This donation of property can also eliminate capital gains tax on the property's appreciation depending on the original purchase prices and the value of the property at the time of your gift.

- Will or Living Trust: If you're hesitant about making an immediate gift of property at this time you may want to consider leaving it to the World Parrot Trust in your will or with a revocable living trust. This can support WPT in the future without using your assets today, and it can be established or modified at any point in time.

How Can I Get Tax Relief?

How to claim

Next Steps

Get in touch with us now to learn more about how you can use any of these options. We would be delighted to help your attorney and other financial advisors in creating the best plan for you.

Get in Touch

Gifts Administrator

Glanmor House, Hayle,

Cornwall TR27 4HB

United Kingdom

Tele: +44 (0) 1736 751026

Share Giving: Donate Shares to Support WPT via ShareGift

Donating Shares

Did you know you can support the World Parrot Trust by donating shares, just as you might donate money? Gifting shares can be a simple and impactful way to contribute to parrot conservation.

Many people choose to support charities by gifting assets like shares during their lifetime or as part of their estate planning. Donating shares can be an efficient, tax-friendly method to contribute to WPT.

Why Donate Shares?

By donating shares, you can support WPT’s mission to protect and conserve endangered parrots worldwide. It’s a particularly tax-efficient way to give, allowing you to make a meaningful impact without out-of-pocket costs.

Benefits of Donating Shares to the World Parrot Trust

Donating shares through ShareGift is a tax-efficient way for UK supporters to contribute to parrot conservation while benefiting from significant tax relief.

If you are a UK taxpayer, you can claim income tax relief on the value of most stocks and securities when you donate them to a charity. In addition, donating shares charitably gives rise to neither a gain nor a loss for Capital Gains Tax (CGT) purposes.

How to Claim Tax Relief

Tax relief is claimed through the Self-Assessment tax return. For personalised advice, consult HMRC or a tax advisor. These examples are based on general tax rates; actual tax benefits may vary.

How does ShareGift work?

ShareGift is a UK-based charity that specializes in handling share donations, particularly small or hard-to-sell holdings. By consolidating these donations, ShareGift sells the shares and distributes the proceeds to various charities, including the World Parrot Trust when recommended by supporters.

This means your Share donation can make a direct impact on the World Parrot Trusts mission to protect and conserve endangered parrots.

How to Donate Shares to WPT through ShareGift

Donating shares via ShareGift is a straightforward process, whether you hold a physical share certificate or have shares held electronically, in your name or with a broker.

Step-by-Step Transfer Process:

- Complete a Donation Form:

Visit ShareGift.org to access the donation form. Be sure to mention the World Parrot Trust in the “suggested beneficiary” section, so your donation may be directed towards parrot conservation.. - Provide Essential Details:

- Your full name, address, and telephone number.

- Details about the shares, including the type and number of shares or units, and how they’re held (certificated or electronic).

- Transfer Coordination:

ShareGift, will handle the transfer. If your shares are certificated, you may be asked to send in the original certificates. For lost certificates, they’ll assist with arranging a letter of indemnity, though a nominal fee (£20-£40) may apply. - Transfer Completion:

Once the required paperwork is submitted, the transfer can typically takes between 2-6 weeks. Transfers of unit trust holdings may take longer. - For more details about ShareGift or to reach their team directly, visit ShareGift.org or call them at 020 7930 3737.

Additional Support and Information

If you’d like more guidance on donating shares or have questions about other ways to support the World Parrot Trust, please email us at support@parrots.org

Your support through Share Giving can make a world of difference in safeguarding endangered parrot species globally, with potential tax savings as an added benefit.

Get in Touch

Gifts Administrator

Glanmor House, Hayle,

Cornwall TR27 4HB

United Kingdom

Tele: +44 (0) 1736 751026

Cause Marketing and Sponsorship

Elevate your brand to new heights with WPT's purpose-driven marketing initiatives. Our suite of services empowers your brand to make a tangible impact, forging a lasting legacy as a change-maker.

WPT offers measurable results:

By partnering with WPT, you'll gain access to a highly-targeted audience, demonstrable program efficacy, robust international conservation connections, and deep-rooted community ties. Together, let's shape a brighter future and position your brand at the forefront of positive change.

Partnership Opportunities

Join esteemed local and global corporations supporting WPT via event underwriting, fundraisers, volunteer initiatives, and product donations. As a non-profit, we rely on corporate allies to optimize our efforts and demonstrate their commitment to environmental preservation and animal welfare.

Gift Aid

Gift Aid is a simple way to increase the value of donations from UK taxpayers. If you're a taxpayer, you've already paid tax on any gifts you've made to the World Parrot Trust (WPT). That means your donation qualifies for Gift Aid.

How This Works

Currently, we are eligible to receive a 25p refund for every £1 donated. This means that if you donate £100, we will receive an additional £25 without any extra cost to you, the donor. We will then utilize this amount to finance WPT's activities.

When a UK taxpayer makes a gift to WPT, tax has already been paid on that money. This money qualifies for Gift Aid. As a registered charity (UK Reg# 800944) WPT can claim an amount equal to the tax paid from HM Revenue & Customs (HMRC). And the best part is — it can increase the value of your gift by 25% at no cost to you!

Can I Gift Aid my Donations?

In order to be eligible for Gift Aid, you must be a UK taxpayer who has paid sufficient tax to cover the amount of tax claimed back by all charities on every donation made within a particular tax year, which spans from 6th April of one year to 5th April of the following year.

Along with taxes paid on income earned from a job or self-employment, other types of taxes that qualify for Gift Aid include:

However, taxes such as VAT and council tax are not eligible for Gift Aid, nor is any non-UK tax.

Next Steps

All we need is your permission to reclaim the tax you have already paid to HMRC.

Simply complete and submit the declaration form to confirm your Gift Aid status, which will enable us to claim your gift aid on all your previous eligible donations, as well as any future gifts.

Get in Touch

Gifts Administrator

Glanmor House, Hayle,

Cornwall TR27 4HB

United Kingdom

Tele: +44 (0) 1736 751026